Wondering what’s next for house prices, mortgage rates, and market activity? We’ve got you covered — Get the full update in our latest blog.

UK Housing Market: A Positive Start to 2025

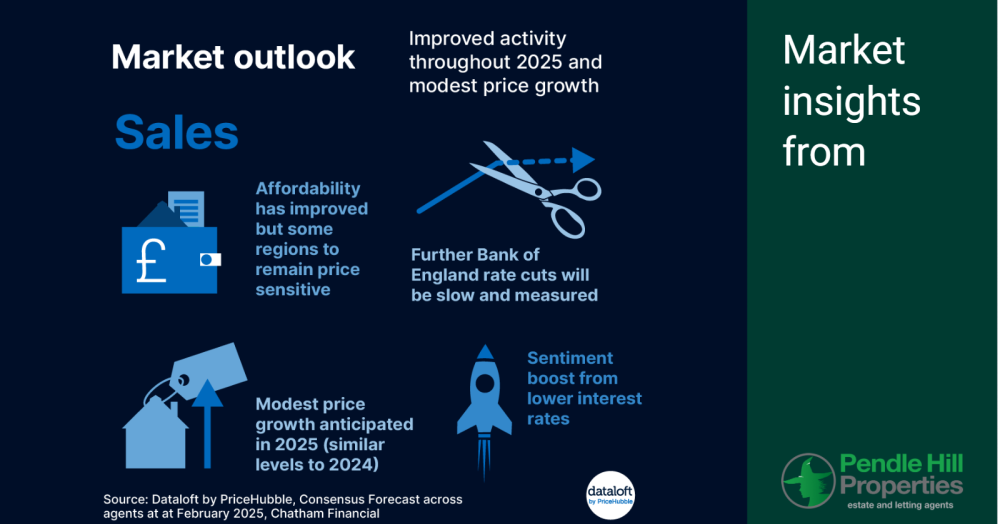

The UK property market has entered 2025 on solid ground. After a tricky period from late 2022 to early 2024, things have now steadied, with activity levels picking up and confidence returning. Experts believe this positive trend will continue throughout the year.

House Prices Set to Grow

Recent forecasts predict house prices will rise by 3.1% in 2025 and 3.7% in 2026 — very similar to the steady growth seen in 2024. This suggests the market is settling into a healthier, more stable pattern after recent ups and downs.

Mortgage Market Steadies

A big reason for this improvement is that mortgage approvals and home sales have returned to more normal levels. These had slowed at the end of 2022 and into early 2024 as interest rates rose and people became cautious.

However, with recent interest rate cuts by the Bank of England, confidence is improving. Longer-term mortgage rates are expected to settle at around 4% or just below, with the 5-year swap rate currently at 4.0%, helping to keep borrowing costs stable.

Affordability Still an Issue in Costly Areas

While the market outlook is positive, buyers in higher-priced areas like London and the South East remain sensitive to affordability. High house prices mean people will continue to be careful about how much they spend, which could slow price growth in these areas compared to more affordable parts of the country.

Opportunities in the New Build Market

One of the bright spots this year is the new build sector. The government is working towards its housebuilding targets, and new homes remain popular with buyers. As market activity improves, new build developments could play a key role in meeting demand and offering more choice to buyers.

A Balanced Outlook

As the market finds its feet in 2025, now is an ideal time to review your property plans. Whether you're looking to buy, sell, or arrange your mortgage, our expert team is ready to support you with clear advice and tailored solutions. Get in touch today on 01282 772048 to start your journey!