Great news for homebuyers! Mortgage rates are dropping below 4% for borrowers with a 60% loan-to-value. Now’s the perfect time to explore your options—read on to learn how Pendle Hill Properties can help you.

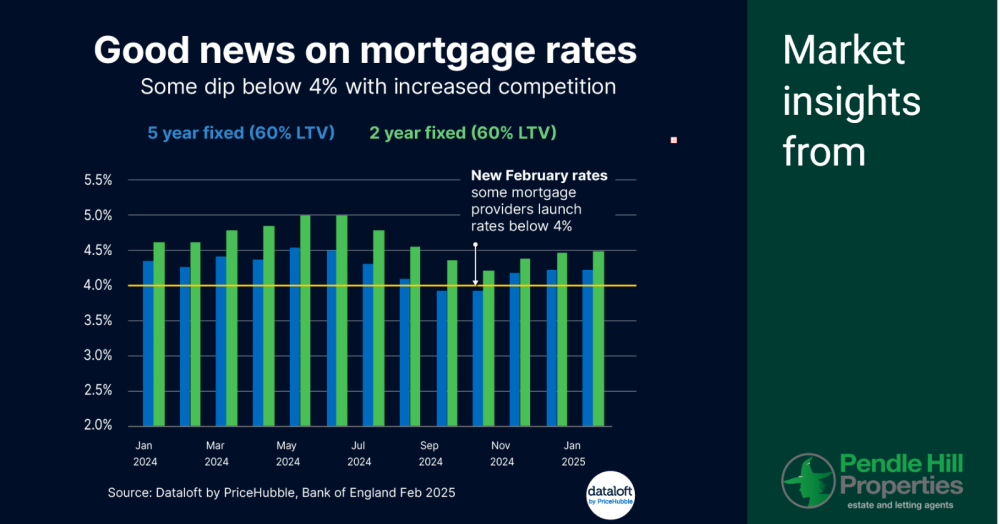

Great news for homebuyers! The mortgage market is seeing some exciting changes, with major lenders now offering deals with interest rates under 4% for borrowers with a 60% loan-to-value (LTV). This is a significant shift, especially after a year of rates staying above 4%. For those with larger deposits, this offers a real opportunity to lock in better, more affordable mortgage deals.

What’s Behind the Shift?

The recent reduction in the Bank of England’s base rate—from 4.75% to 4.5%—is a key factor behind the change. With further rate cuts expected in the months ahead, lenders are becoming more confident and competitive. Experts predict the base rate could drop to 3.75% by the end of the year, meaning more opportunities for borrowers to secure lower rates.

What Does This Mean for Borrowers?

If you’ve been waiting for a better deal, the time has come. While the sub-4% rates are currently mainly available for those with larger deposits, this is a sign of positive changes to come. Rates on other products could follow suit shortly, creating even more opportunities for buyers. Whether you’re a first-time buyer, looking to remortgage, or just considering your options, the increased competition in the mortgage market is great news for you.

How We Can Help

At Pendle Hill Properties, we understand that buying a home is a big decision. With these competitive mortgage deals, now is an ideal time to explore the local market. The shift in interest rates means you may be able to secure a mortgage deal that fits your budget, making your dream home more affordable than ever.

If you're considering taking advantage of these exciting changes in the mortgage market, our expert mortgage advisors are here to help. With the recent shift in interest rates, navigating your options can be overwhelming, but our team is ready to guide you every step of the way. Whether you're a first-time buyer or looking to remortgage, we'll ensure you find the best mortgage deal that suits your needs and budget. Call us today for personalised, professional advice and make the most of the current opportunities in the market!

Contact Pendle Hill Properties today and let us help you secure the perfect home at the best price!