Considering a property purchase? Understanding the current mortgage landscape is crucial. This guide cuts through the noise, offering direct insights to help you secure the best financing for your new home.

As estate agents, we know that securing the right mortgage is often the biggest hurdle for buyers. The economic climate is constantly evolving, and staying informed is key to making confident decisions. We pride ourselves on being open, honest, and clear, and that extends to connecting you with the best advice.

Current Economic Landscape: What You Need to Know

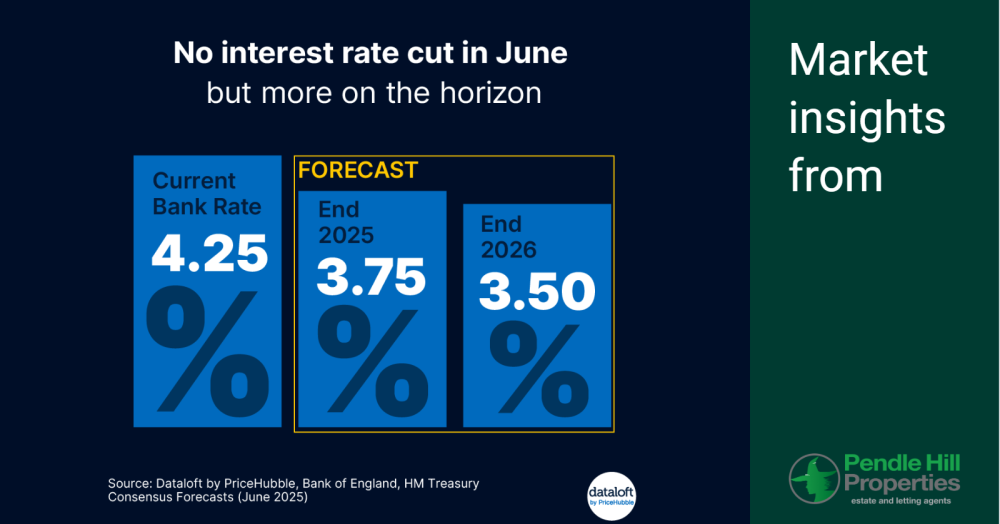

Let's look at the latest figures that could impact your mortgage. The Bank of England held its bank rate steady at 4.25% in June. While this stability is welcome, there's good news on the horizon: potential cuts are anticipated as early as August. Looking further ahead, consensus forecasts, drawing from Dataloft by PriceHubble, the Bank of England, and HM Treasury Consensus Forecasts (June 2025), predict year-end rates of 3.75% and 3.5% by the end of next year. This suggests a more favourable borrowing environment could be on its way.

However, it's not all plain sailing. Current inflation stands at 3.4%. While this is a reduction from previous highs, there's still potential for further inflationary pressures, particularly due to geopolitical tensions affecting oil prices. This interplay between interest rates and inflation means that expert mortgage advice is more valuable than ever.

Why Expert Mortgage Advice is Non-Negotiable

Navigating these economic nuances can be complex. That's why we strongly encourage all our buyers, whether you're looking at a starter home at £80,000 or a substantial detached 4-bedroom property in the £250,000 to £500,000 bracket, to seek professional mortgage advice. We provide the same high-quality service to all our clients, regardless of property value, and that includes connecting you with trusted partners.

We've seen countless buyers benefit from tailored advice. For instance, a few months ago, a young couple, first-time buyers, were feeling overwhelmed by the different mortgage products available. After a session with our recommended advisor, they not only understood their options but also secured a deal that saved them hundreds of pounds a month. This personal touch and clear guidance are what make all the difference.

Meet Callum Booth: Your Mortgage Expert

We are delighted to recommend Callum Booth for all your mortgage advice needs. Callum is an independent mortgage advisor who understands the intricacies of the market and can provide personalised guidance based on your unique financial situation and the latest economic data. He's fantastic at cutting through the jargon and getting straight to what matters.

Callum is available for meetings at our agency's offices, via Zoom for your convenience, or even at your home, ensuring you receive advice in a way that suits you best. He can help you understand how current rates, potential future cuts, and inflationary pressures might impact your borrowing power and repayment plans. Don't leave your biggest financial decision to chance.

Take the Next Step

Whether you're a seasoned buyer or just starting your property journey, getting professional mortgage advice is a crucial step. Contact us today to arrange a no-obligation consultation with Callum Booth. He's ready to help you unlock your buying potential and make your property dreams a reality. Let's get you moving!

Give us a call on 01282 772048 / 01772 319421 or drop us an email to info@pendlehillproperties.co.uk