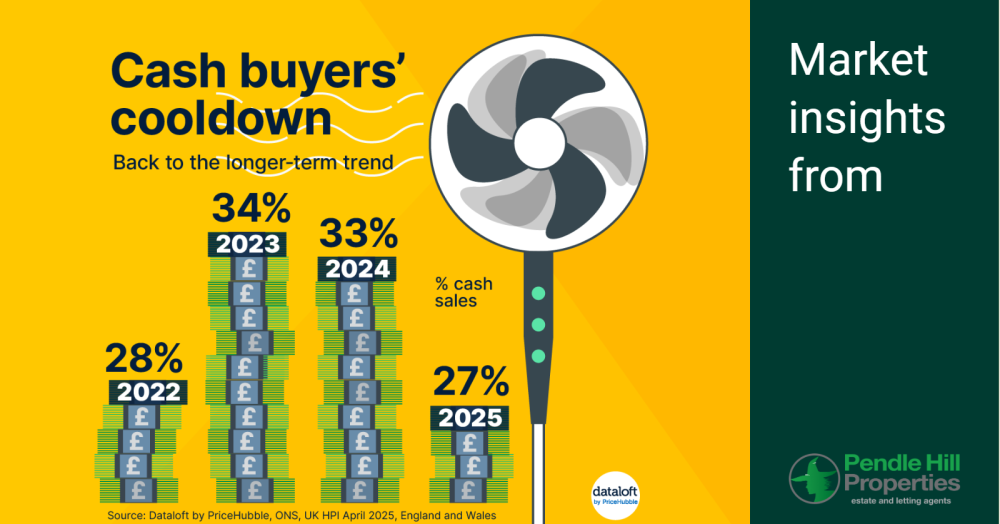

The property market is constantly evolving, and recent trends indicate a notable shift in buyer demographics. Understanding the decline in cash buyers across Great Britain is crucial for anyone involved in property transactions, from sellers to aspiring homeowners.

For years, cash buyers have been seen as the golden ticket in property transactions – offering speed, certainty, and often a smoother process. However, recent data suggests a significant decline in their presence across Great Britain. This shift isn't just a statistical anomaly; it reflects broader economic changes and has tangible implications for how properties are bought and sold.

Understanding the Decline

Several factors contribute to this trend. Firstly, the rising cost of living and inflationary pressures mean that fewer individuals or families have substantial liquid assets readily available for a full cash purchase. Secondly, the Bank of England's interest rate adjustments have made mortgage products more attractive for some, even for those with significant savings, as they might prefer to keep their capital invested elsewhere. Furthermore, the increased scrutiny on money laundering regulations has also added layers of complexity to large cash transactions, making them less straightforward for some.

The Impact on Sellers

For sellers, this decline means a potential adjustment in expectations. While a cash offer still holds appeal, it's becoming less common. Estate agents are now more frequently advising clients to prepare for transactions involving mortgage finance, which can sometimes entail longer timelines and additional conditions. This necessitates a more patient and strategic approach to selling.

Our Experience: A Local Perspective

At Pendle Hill Properties, we've certainly observed this trend firsthand. Just last month, we were marketing a lovely four-bedroom detached house in the £400,000 bracket. Historically, we might have expected a couple of cash offers. This time, however, all serious enquiries came from buyers requiring mortgage finance. It meant we had to work even more closely with all parties, ensuring clear communication between solicitors and lenders to keep the chain moving efficiently. It reinforced our commitment to providing open, honest and accurate advice, guiding our vendors through every step, regardless of the buyer's financial position.

What This Means for Buyers

For buyers, particularly those relying on mortgages, this shift can be seen as both a challenge and an opportunity. While competition from cash buyers might be easing, the mortgage market itself requires careful navigation. Securing a 'mortgage in principle' early on is more critical than ever, demonstrating your readiness and commitment to sellers. It also highlights the importance of working with a reputable mortgage advisor who can help you secure the best rates and products available.

Adapting to the New Landscape

The property market is dynamic, and successful estate agents must adapt. Our approach at Pendle Hill Properties combines Andrew's direct, no-nonsense advice with Tom's enthusiastic and forward-thinking perspective. This blend ensures we provide comprehensive support, whether you're selling a starter home or a substantial family residence. We pride ourselves on delivering consistent service quality across all price points, from £80,000 flats to £1,000,000 detached homes.

The decline in cash buyers isn't a sign of a weakening market, but rather a maturing one. It underscores the importance of professional guidance, transparent communication, and a robust understanding of current financial trends. By staying informed and working with experienced estate agents, both sellers and buyers can navigate this evolving landscape successfully.