Take a look back at the housing market of 2024 and projections for 2025

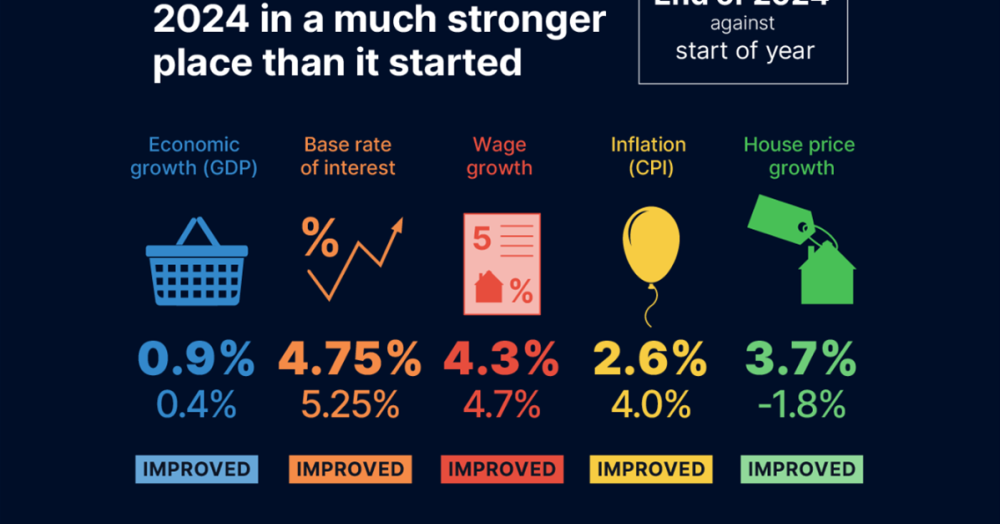

As we look back on 2024, it’s clear that the housing market experienced a remarkable recovery throughout the year. At the start of 2024, the outlook was far from optimistic. Interest rate cuts hadn’t yet begun, inflation was double the target rate, and economic growth seemed too weak to fuel meaningful house price growth.

However, by the end of the year, the housing market defied expectations, with house prices growing by 3.7%. This growth was driven by significant improvements in several key economic factors, which had a major impact on the residential property market.

Key Drivers of Change

One of the most important factors behind the market's rebound was the steady decline in inflation. As inflation eased, the Bank of England was able to begin cutting interest rates. This provided much-needed relief to homeowners and potential buyers, with five-year mortgage rates improving compared to both the previous year and the year before that.

Though inflation remained slightly above the target by the end of the year, its downward trajectory played a critical role in easing financial pressures, creating a more favourable environment for the housing market.

Economic Growth: Sluggish but Steady

Economic growth in 2024 was less than stellar, with a few notable pauses throughout the year. Uncertainty surrounding the General Election in July and the Budget in October caused temporary slowdowns. Despite these setbacks, the broader economic picture showed steady improvement, helping to maintain consumer confidence and support the housing market’s upward trend.

What Lies Ahead in 2025?

As we settle into 2025, the outlook for the housing market remains cautiously optimistic. Economic forecasts suggest that GDP growth may see modest upside this year, providing a stable foundation for continued resilience in residential prices. While inflation is still slightly above the target, it is lower than the levels of previous years, helping to ease financial pressures across the board.

Looking back at 2024, it’s clear that, despite facing a range of challenges, the housing market showed remarkable resilience. With key economic drivers now improving—such as lower inflation, rate cuts, and steady growth—the momentum built in 2024 seems poised to carry over into this year. While uncertainties remain, there’s cautious optimism for a continued recovery and a stable housing market throughout 2025.

Thinking of Buying Your First Home in 2025? Pendle Hill Mortgages Can Help!

If you're considering purchasing your first home this year, now is an exciting time to take that step. With interest rates expected to continue falling and a more favourable economic environment in place, the housing market in 2025 offers plenty of opportunities for first-time buyers. At Pendle Hill Mortgages, our expert mortgage advisors are here to guide you through every part of the home-buying journey. We understand that purchasing your first home can feel overwhelming, but with our help, you’ll feel confident and informed every step of the way.

We have access to a wide range of mortgage products, ensuring we can find the right one to suit your financial situation and goals. Our team will work closely with you to secure competitive rates, and we'll make sure you fully understand all your options—so you can make the best decision for your future.

If you’re ready to take the next step toward homeownership in 2025, Pendle Hill Mortgages is here to help you make it happen. Let’s make your dream home a reality!

Contact us now on 01282 772048 for your free consultation!