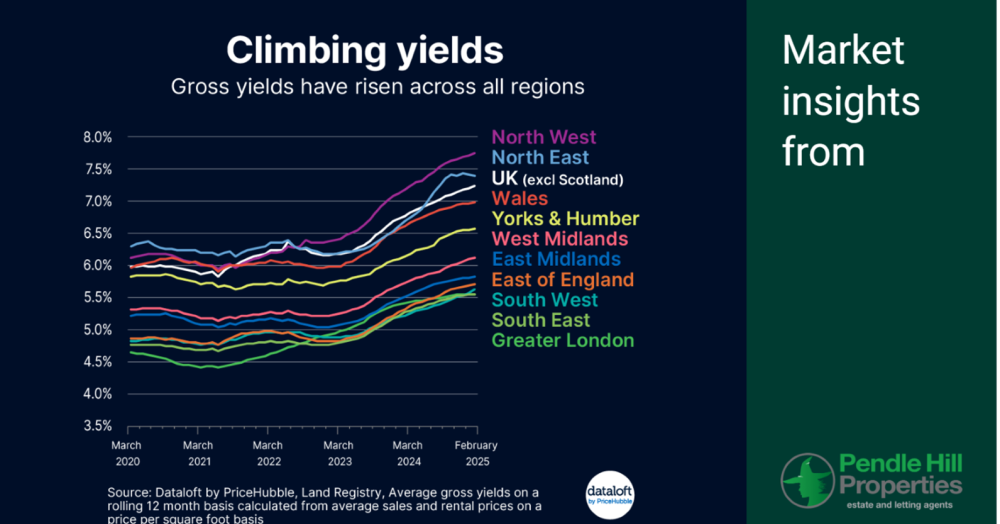

Rental Yields Reach Five-Year High Amid Market Shifts

1 in 10.6 Burnley sellers lower their asking price - but it doesn’t have to be that way. See what the data reveals and how Pendle Hill Properties Members Club keeps you ahead of the market!

Discover how Burnley’s property market has evolved over the past decade. From subtle price rises to standout growth areas, explore the map that tells the story of our town’s changing housing landscape.

The much-loved Pendle Hill Properties Trick or Treat Trail is returning to Longridge this October half-term for a week of frightful family fun.

The UK property market in Week 40 of 2025 shows steady seasonal shifts. New listings dip slightly, sales remain strong, and rental prices continue their upward climb. Here’s a snapshot of the key trends shaping the housing landscape this autumn!