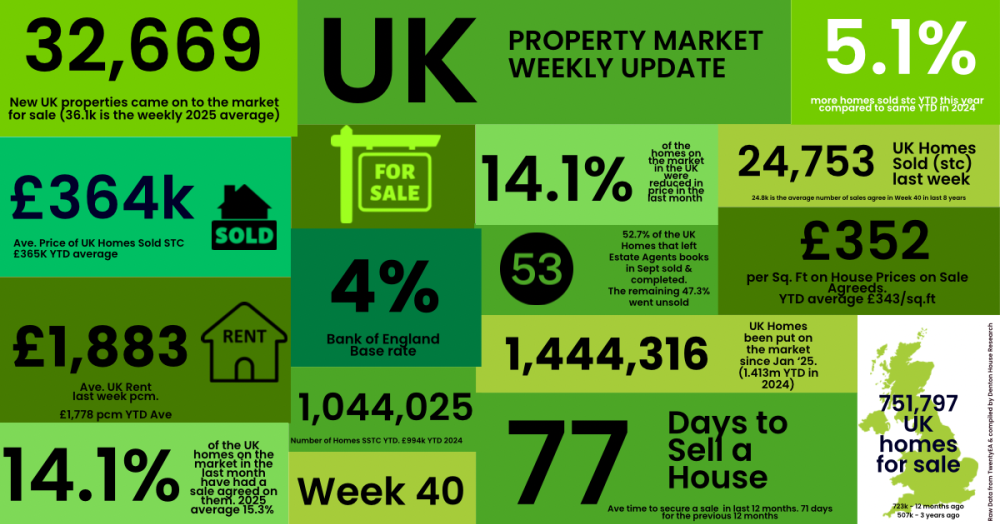

The UK property market in Week 40 of 2025 shows steady seasonal shifts. New listings dip slightly, sales remain strong, and rental prices continue their upward climb. Here’s a snapshot of the key trends shaping the housing landscape this autumn!

✅ New Listings

• 32.7k new properties came to market this week, down as expected from 34.3k last week.

•2025 weekly average: 36.1k.

• Nine-year week 40 average :33.4k

•Year-to-date (YTD): 1.44m new listings, 2.2% higher than 2024 YTD (1.41m) and 10% above the 2017–19 average (1.31m)

✅ Price Reductions

•24.6k reductions this week, slightly higher to last week at 25.6k.

•Increase in the number of homes on the market being reduced in September to 14.1%. In August, it was 11.1% (everyone must have been on holiday!), whilst it was 14.1% in July and 14% in June.

•2025 average so far: 13.2%, versus the five-year long-term average of 10.74%.

✅ Sales Agreed

•24.8k homes sold subject to contract this week, down as expected from 25.6k last week.

• Week 40 average (for last 9 years) :24.8k

•2025 weekly average : 26.1k.

•YTD: 1.044m gross sales, which is 5.1% ahead of 2024 (994k) and 13.2% above the 2017–19 average (922k).

✅ Price Diff between Listings & Sales

• Average Asking Price of listings last week £432k vs Average asking price of Sales Agreed (SSTC) - £364k

•18.7% difference (long term 9 year average is 16% to 17%)

✅ Sell-Through Rate

•14.1% of homes on agents’ books went SSTC in September.

•Down from 14.5% in Aug, 15.4% in July, 15.3% in June, and 16.1% in May.

• Pre-Covid average: 15.5%.

✅ Fall-Throughs

• 6,262 fall-throughs last week (pipeline of 510k home Sold STC).

•Weekly average for 2025: 6,562.

•Fall-through rate: 25.3%, up from 24.6% last week.

• Long-term average: 24.2% (post-Truss chaos saw levels exceed 40%).

✅ Net Sales

•18.5k net sales this week, up from 19.4k last week.

• Nine-year Week 40 average: 18.2k.

• Weekly average for 2025: 19.9k.

•YTD: 795k, which is 4.3% ahead of 2024 (762k) and 10% above 2017–19 (724k).

✅ Probability of Selling (% that Exchange vs withdrawal)

•Preliminary September Stats : 52.7% of homes that left agents’ books exchanged & completed. (Note this will change as more September stats come in in throughout October)

•August :55.8% / July: 50.9% / June: 51.3% / May: 51.7% / April: 53.2%.

✅ Stock Levels

•751k homes on the market at the start of October, 4% higher than October 2024. (723k)

•510k homes in sales pipeline on the 1st October, 2% higher than 12 months ago.

✅ House Prices (£/sq.ft)

•October 2025 agreed sales averaged £336.54 per sq.ft.

✅ Rentals

•Average Monthly Rents by region

· East Midlands - £1,070 (Growth since 2016) - 46.2%

· East Anglia - £1,396 (Growth since 2016) - 30.7%

· Inner London - £3,113 (Growth since 2016) - 24.9%

· North East - £968 (Growth since 2016) - 27.7%

· North West - £1,318 (Growth since 2016) - 64.1%

· Northern Ireland - £961 (Growth since 2016) - 41.1%

· Outer London - £1,948 (Growth since 2016) - 22.3%

· Scotland - £1,157 (Growth since 2016) - 52.2%

· South East - £1,619 (Growth since 2016) - 26.2%

· South West - £1,354 (Growth since 2016) - 48.3%

· Wales - £1,092 (Growth since 2016) - 44.4%

· West Mids - £1,092 (Growth since 2016) - 35.1%

· Yorks & Humberside - £1,031 (Growth since 2016) - 36.2%

•Average UK rent in September - £1,846 - a growth 2.44% from Sept 2024

•297k rental properties were available in Sept ’25 (286k - Sept 24 & 229k in Sept ’23)

If you would like to chat about our local property market, feel free to drop me a call on 01282 772048 or email me at info@pendlehillproperties.co.uk