If you're a first-time buyer or thinking about stepping onto the property ladder, you're not alone! Have a read of our blog for some more information.

According to the latest English Housing Survey, over 975,000 first-time buyers entered the market in England between 2020 and 2023 — that's an average of 325,000 each year. Despite the challenges posed by rising mortgage rates, many still see homeownership as an achievable and worthy goal. Here's what you need to know if you're planning to buy your first home.

First-Time Buyers Are More Common Than You Think

The number of first-time buyers in England has remained strong, with 325,000 entering the market annually. This is an impressive statistic, especially when considering the rising mortgage rates over the past few years. While challenges to affordability have made it harder for some, the dream of owning a home is still alive for many people.

The Age of First-Time Buyers: A Changing Trend

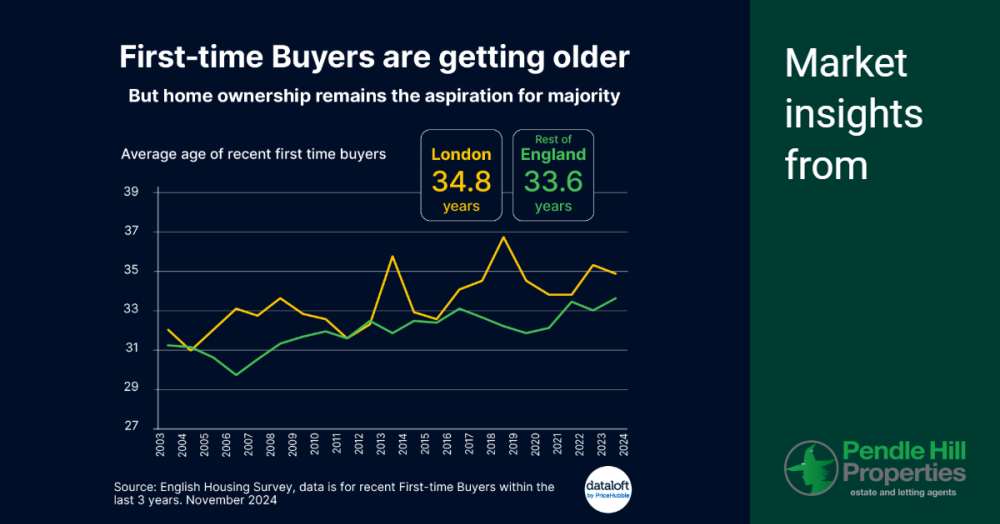

The average age of a first-time buyer in England has been creeping up in recent years. As of 2023, the average first-time buyer is 33.6 years old, up from 32.1 just five years ago and 31.9 in 2014. This shift may reflect a range of factors, such as the rising costs of living, the need to save for a larger deposit, and perhaps the growing importance of job stability before making a large financial commitment like buying a home.

In London, the average age is even higher at 34.8 years, although it's worth noting that this number has slightly decreased over the past year. This is a shift from previous peaks, where the average age reached over 35 in 2013/14 and 2018/19.

Homeownership Still a Dream for Many Renters

Despite the challenges, homeownership remains a top priority for renters. A recent survey found that over half (57%) of private renters, equating to about 2.6 million households, plan to buy a home in the future. Of these renters, a quarter aim to make their purchase within the next two years. For many, the goal of owning a home is a driving force, and the possibility of buying is on the horizon.

Local First-Time Buyers: Bringing it back to Longridge

In Longridge, the average age of a first-time buyer is notably younger than the national average. At just 28.3 years old, first-time buyers in Longridge are entering the property market earlier than in many other areas of England. This is a stark contrast to the national average of 33.6 years old for first-time buyers in England. The local property market in Longridge offers an attractive option for those looking to get onto the housing ladder at a younger age, offering both a sense of community and more accessible housing options for first-time buyers.

Final Thoughts for First-Time Buyers

For first-time buyers, it's essential to understand the broader market trends and plan accordingly. Whether you're saving for a deposit or researching mortgage options, know that you're part of a larger group of people working toward the same goal. Homeownership might feel out of reach sometimes, but with careful planning, you can make it a reality.

The property market may have its challenges, but it also offers plenty of opportunities. Stay informed, save wisely, and take your time – your dream home could be closer than you think.

How we can help: Pendle Hill Mortgages

If you're considering purchasing your first home in Longridge or the surrounding areas, Pendle Hill Mortgages is here to help. Our expert mortgage advisors are dedicated to guiding you through the entire home-buying process. With access to a wide range of mortgage products, we'll work with you to secure competitive rates and ensure you understand all your options. Let Pendle Hill Mortgages take the stress out of securing your dream home and make your journey to homeownership as smooth as possible.

Contact us now on 01772 319421 for your free consultation!