Buying your first home in Burnley? It’s not as tough as the headlines suggest! We break down the facts, figures, and history to show why it’s more achievable than you think — read below to find out more.

The typical first-time buyer home in Burnley costs £78,275, which is a lot of money in anyone's book.

At Pendle Hill Properties, we know how overwhelming that figure can feel, especially when you're weighing up your very first home. But when you look past the headlines, affordability in Burnley isn't as bleak as many think.

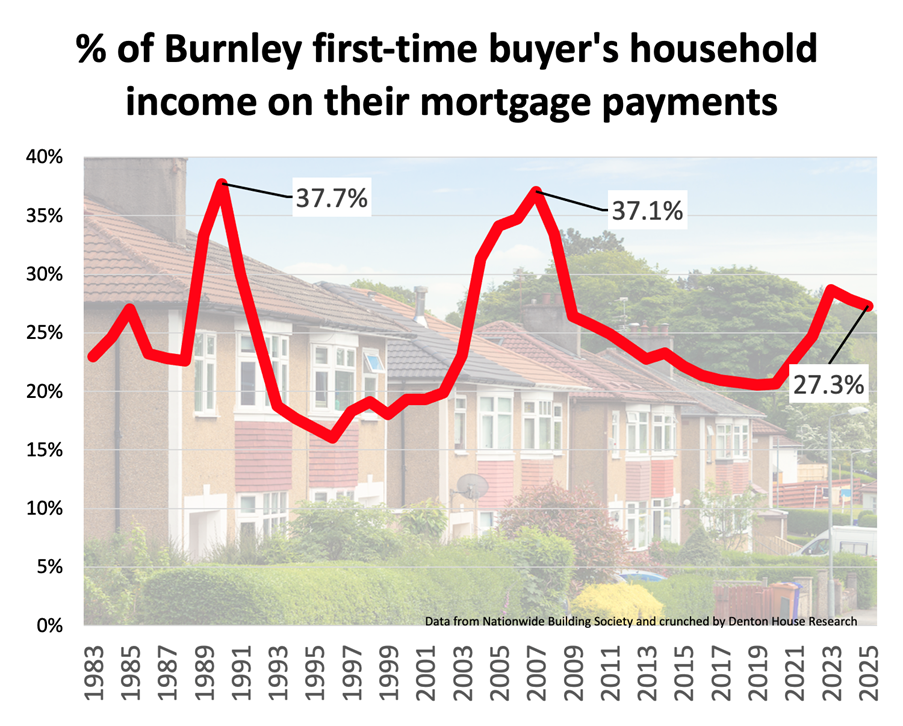

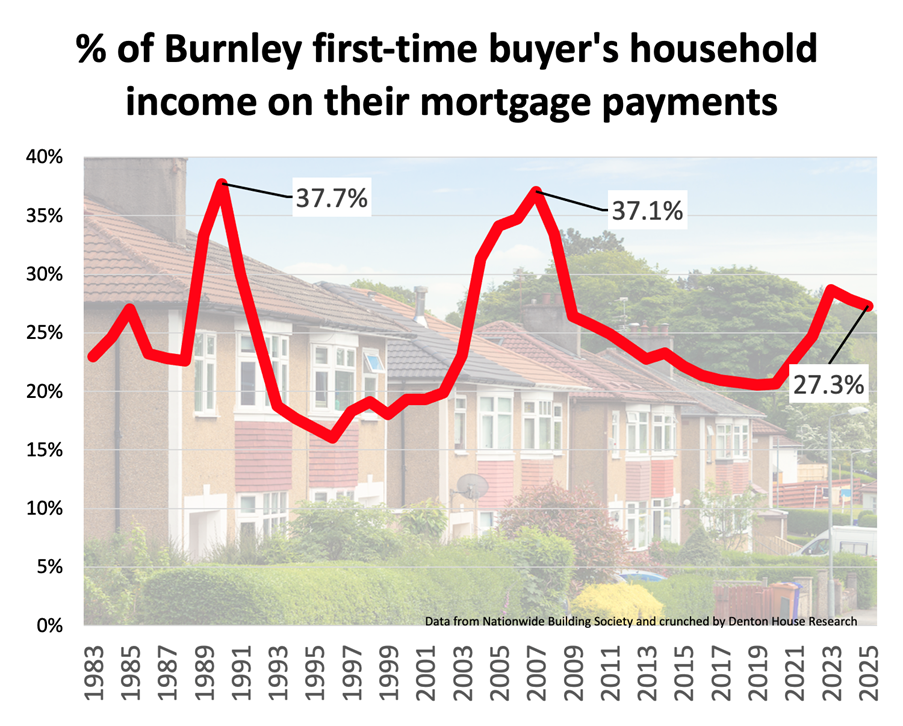

The Late 1980s / Early 1990s Squeeze

Cast your mind back to the late 1980s. House prices were much lower, but interest rates were a punishing 14.4%. In 1990, first-time buyers in Burnley were handing over 37.7% of their household income to cover mortgage payments.

By comparison, today's buyers face a different challenge. The lesson here, and something we often share with our clients, is that affordability isn't just about the price tag - it's about the balance between wages, interest rates, and monthly repayments.

2007: Déjà Vu for New Burnley First-Time Buyers

In 2007, first-time buyers in Burnley were committing 37.1% of their income to mortgage costs. That's significantly higher than today, despite house prices being lower back then.

This shows that every generation has faced hurdles. We often remind buyers that it's not about waiting for the “perfect” time - it's about making the right decision with the right support.

The 2023 Peak

In 2023, affordability hit a recent high, with Burnley first-time buyers spending 28.7% of their income on mortgages. Many people delayed their plans, but even then, it was still easier in percentage terms than both 2007 and the late 1980s.

That perspective is crucial. With guidance, buyers can cut through the noise and see that opportunities still exist, even in tougher years.

A Glimmer of Relief for Burnley First-Time Buyers

Since 2023, the pressure has started to ease. By 2025, mortgage costs dropped to 27.3% of income. Still demanding, but trending in the right direction.

This reminds us that the market moves in cycles. Knowing when and how to act is key and that's where having trusted local advice can make all the difference.

The Role of Wages and Inflation

In real terms, UK homes are now around 11% cheaper than in 2022, while wages have grown nearly 5% after inflation. That combination is rare - and gives first-time buyers more negotiating power.

This is why we encourage buyers to look beyond headline prices. It's the balance of wages, inflation, and interest rates that really determines affordability.

Why the Headline Asking Price of Homes Distracts Us

A starter home in Burnley may look daunting when you compare it with salaries, but monthly affordability is often better than people think. A six-figure asking price can feel out of reach, yet the actual repayment may well be manageable.

That's why many first-time buyers take the plunge once they see the numbers clearly set out.

Peaks and Troughs in Perspective

History shows affordability goes in cycles. There will always be peaks and troughs, but people continue to get on the ladder through every one of them.

Final Thought

Buying your first home in Burnley will never be “easy.” It takes saving, sacrifice, and courage. But don't fall for the myth that it's uniquely impossible today - past generations faced even tougher times, and they still found a way.

About Us – How Pendle Hill Properties Can Help

At Pendle Hill Properties, we understand the challenges first-time buyers in Burnley face, because helping people take that important first step onto the property ladder is at the heart of what we do.

Here's how we support first-time buyers in Burnley:

Personal Support: From arranging viewings to connecting you with our trusted mortgage advisor, we make the process less daunting and more manageable.

Local Market Expertise: We know Burnley inside out, meaning we can point you towards the right areas, the right homes, and the right opportunities.

First-Time Buyer Guidance: We'll walk you through the process, explain the jargon, and make sure you feel confident about your decisions.

Buying your first home should be exciting, not overwhelming. At Pendle Hill Properties, we're here to turn the dream into a reality – helping you find not just a house, but a home.

Get in touch on 01282 772048 today!