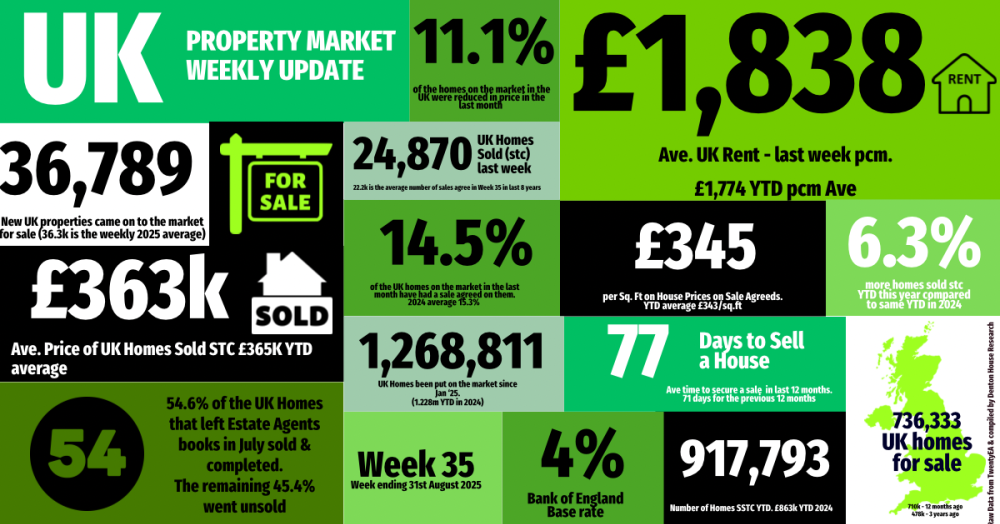

The latest UK property stats for Week 35 of 2025 show a busy post-Bank Holiday market, with new listings, sales, and prices gaining momentum. Despite fall-throughs and price cuts, performance remains ahead of 2024 and pre-Covid levels, pointing to a positive outlook for autumn.

Check out the UK Property Market stats for week 35 of 2025

✅ New Listings

• 36.8k new homes came to market this week, up from 29.1k last week (post Bank Holiday effect).

• 2025 weekly average: 36.2k.

• Year-to-date (YTD): 1.27m new listings, 3.3% higher than 2024 YTD and 10.7% above the 2017–19 average.

✅ Price Reductions

• 25.7k reductions this week, up from 17.5k last week.

• Only 11.1% of homes were reduced in August, compared with 14.1% in July and 14% in June.

• 2025 average so far: 13.1%, versus the five-year long-term average of 10.7%.

✅ Sales Agreed

• 24.9k homes sold subject to contract this week, up from 21.3k last week.

• Weekly average for 2025: 26.2k.

• YTD: 918k, which is 6.3% ahead of 2024 and 13.7% above the 2017–19 average.

✅ Sell-Through Rate

• 14.5% of homes on agents’ books went SSTC in August.

• Down from 15.4% in July, 15.3% in June, and 16.1% in May.

• Pre-Covid average: 15.5%.

✅ Fall-Throughs

• 6,408 fall-throughs last week (pipeline of 510k home Sold STC).

• Weekly average for 2025: 6,212.

• Fall-through rate: 25.8%, up from 24.1% last week.

• Long-term average: 24.2% (post-Truss chaos saw levels exceed 40%).

✅ Net Sales

• 18.5k net sales this week, up from 16.2k last week.

• Nine-year Week 35 average: 16.9k.

• Weekly average for 2025: 20k.

• YTD: 700k, which is 5.3% ahead of 2024 (665k) and 10.1% above 2017–19 (636k).

✅ Probability of Selling (% that Exchange vs withdrawal)

• Preliminary August: 54.9% of homes that left agents’ books exchanged & completed.

• July: 50.9% / June: 51.3% / May: 51.7% / April: 53.2%.

✅ Stock Levels (1st of Month)

• 763k homes on the market at the start of September, 6.7% higher than Sept 2024.

• 510k homes in pipelines, 3.4% higher than August 2024.

✅ House Prices (£/sq.ft)

• August 2025 agreed sales averaged £338.78 per sq.ft.

• 1.41% higher than August 2024, and 14.25% higher than August 2020.

✅ Rental Market (in arrears)

• August 2025 average rent: £1,828 pcm (vs £1,779 pcm in August 2024).

• YTD 2025 average: £1,774 pcm.

If you would like to chat about our local property market, feel free to drop me a call on 01282 772048 or email me at info@pendlehillproperties.co.uk